Backdoor roth ira calculator

The Roth IRA five-year rule mandates a five-year waiting period for tax-free withdrawals of earnings. A backdoor Roth IRA may be one way for you to avoid Roth IRA income limits.

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement.

. If income thresholds make direct Roth IRA contributions impossible you can always opt for a backdoor Roth IRA conversion. Often a non-deductible IRA is just a layover on the flight from taxable income to a Roth IRA. This type of backdoor account is funded with savings that are converted or transferred into it from a traditional IRA.

Backdoor Roth IRA. Select I converted some or all of it to a Roth IRA and Continue. Like traditional IRAs Roth IRAs have income limits.

This is sometimes called a backdoor Roth IRA because instead of investing money in a Roth you are converting money. Options When Youre a Roth IRA Beneficiary. A backdoor Roth IRA works like this.

A backdoor Roth IRA lets you convert a traditional IRA to a Roth even if your income is too high for a Roth IRA. Next choose Yes all of this money was converted to a Roth IRA. For 2021 you cant contribute if your income exceeds 144000 as a single filer or 214000 as a married couple filing jointly.

Do it yourself retirement. A backdoor Roth is an excellent option for those who want to take advantage of a Roth IRA but their income makes them ineligible for direct contributions. You can also use the Roth Conversion Calculator to get ideas for how much to convert this year.

Backdoor Roth IRA conversions let you circumvent the limits in the table above. This is an IRS-approved strategy that allows high earners to gain access. An individual retirement account IRA is a smart investment vehicle for a variety of investment goals.

Advantages and Tax Implications Explained. A backdoor Roth IRA is an investment strategy that involves converting funds from a traditional IRA to a Roth IRA. An icon in the shape of an angle pointing down.

A backdoor Roth IRA is a completely legal strategy for high-income taxpayers to avoid the Roths income limits. Related Retirement Calculator Investment Calculator Annuity Payout Calculator. You open a new traditional IRA make non-deductible contributions to it then.

Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. You can take advantage of a backdoor Roth IRA. There are a few tax implications of a backdoor Roth IRA including income.

How to Invest in Stocks. It can help set you up for retirement even if you already contribute to a 401k and it. A backdoor Roth IRA is an IRA funded from a traditional IRA through a backdoor route that skirts Roth IRA upper-income limits.

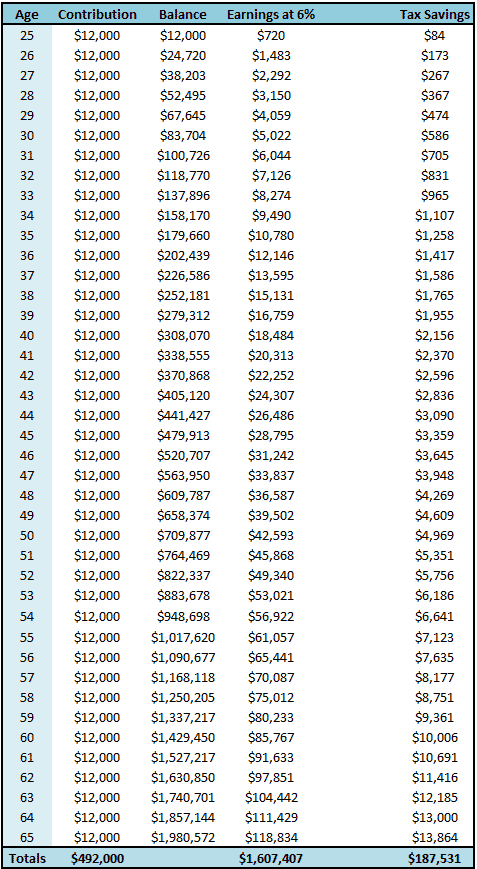

Our free Roth IRA calculator can calculate your maximum annual contribution and estimate how much youll have in your Roth IRA at retirement. Individual Retirement Accounts. Continue answering questions until you come to the screen Your 1099-R Entries.

To check the results of your backdoor Roth IRA conversion see your Form 1040. Can IRAs Reduce Your Taxable Income. Those with any level of income can still use a backdoor Roth IRA.

The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be withdrawn tax-free. Non-Deductible IRAs and Backdoor Roth Conversion. With a conversion you can get around both the income and contribution limits.

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The Best Roth Ira Calculator District Capital Management

Nerdwallet Roth Ira Calculator Results Explained With Examples 2022 Youtube

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Conversion Analysis Software And Optimal Strategy

What Is The Best Roth Ira Calculator District Capital Management

Factors To Consider When Contemplating A Backdoor Roth Ira

Help Understanding This Roth Ira Calculator R Personalfinance

Roth Ira Calculator Roth Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Calculator See What You Ll Have Saved Dqydj

Systematic Partial Roth Conversions Recharacterizations

Is It Worth Doing A Backdoor Roth Ira Pros And Cons

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal